Description

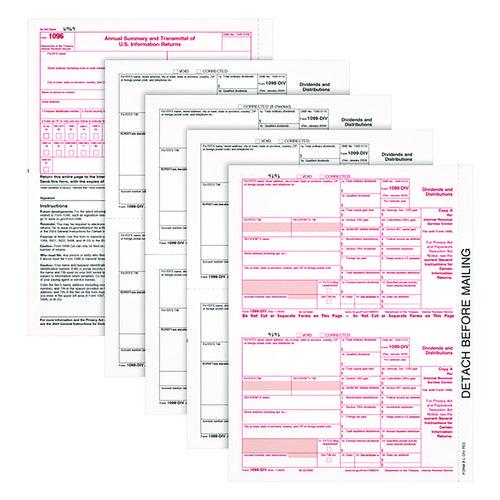

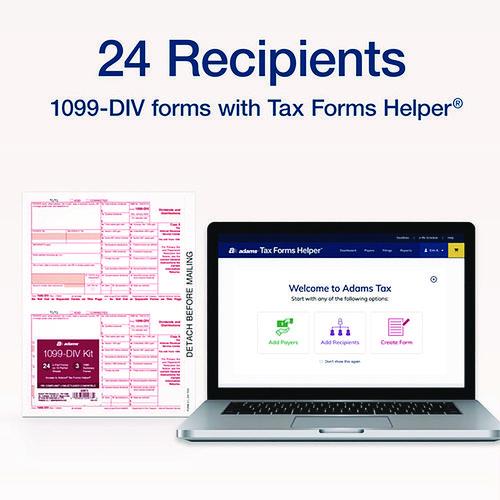

With 4-Part 1099-DIV tax forms, 1096 summaries and access to Adams® Tax Forms Helper®, filing couldn't be easier. In just a few clicks, Tax Forms Helper® allows you to upload your 1099-DIV data directly from QuickBooks® Online or import your details from a previous year. Per the 2023 IRS eFile law, if you're filing 10 or more forms, you'll need to eFile, and Tax Forms Helper® makes it easy to comply with a secure IRS/SSA eFile system. Starting in 2024, the IRS has also removed Copy-C from the 1099-DIV form set, so use the Helper to save your digital copies, too! Use 1099-DIV forms to detail gross dividends and other distributions valued at $10 or more on stock investment expenses, capital gain dividends, non-taxable distributions and liquidation distributions. As of 2022, Form 1099-DIV is also an IRS continuous-use form, with a fill-in-the-year date field that makes it suitable for multiple tax years. All Adams® tax forms employ acid-free paper and heat-resistant inks to help you produce smudge-free, archival-safe tax forms with the scannable red ink required by the IRS for paper filing.Package Includes: (3) 1096 Summary & Transmittal Form